“CBN Confident Naira Will Stabilise as Investor Confidence Grows”

The Central Bank of Nigeria (CBN) has expressed confidence that the naira will stabilise as investor confidence continues to grow. During his address at the Monetary Policy Forum (MPF) in Abuja on Thursday, CBN Governor, Yemi Cardoso, stated that the policies the bank has introduced are paving the way for Nigeria’s long-term economic stability.

The Central Bank of Nigeria (CBN) has expressed confidence that the naira will stabilise as investor confidence continues to grow. During his address at the Monetary Policy Forum (MPF) in Abuja on Thursday, CBN Governor, Yemi Cardoso, stated that the policies the bank has introduced are paving the way for Nigeria’s long-term economic stability.

Cardoso acknowledged that the naira had experienced significant volatility recently but reassured stakeholders that the currency is heading toward stability. “Yes, the naira has seen quite some volatility, but we believe it is moving towards a more stable position,” he said.

He further emphasized that, from the perspective of the international community and investors, the naira is now more reflective of its true value, which has made it more competitive in the global market.

Cardoso also highlighted an increase in foreign interest in Nigeria, noting that this growing investor confidence is critical to the country’s economic recovery. He called for continued collaboration between policymakers, the private sector, and civil society to drive positive change in the country.

The Governor discussed how the MPF served as an essential platform for dialogue, allowing key stakeholders to share insights and refine strategies for Nigeria’s economic future. “This forum is designed for rigorous intellectual discourse, providing an opportunity to address monetary policy challenges precisely, with evidence-based recommendations to improve policy outcomes,” Cardoso explained.

On Nigeria’s foreign exchange market, Cardoso reported notable improvements, citing narrowing exchange rate disparities and an increase in the country’s external reserves, which exceeded $40 billion by December 2024. He attributed this growth to organic factors, stating that not only has the reserve amount risen, but the health of the reserves has also strengthened.

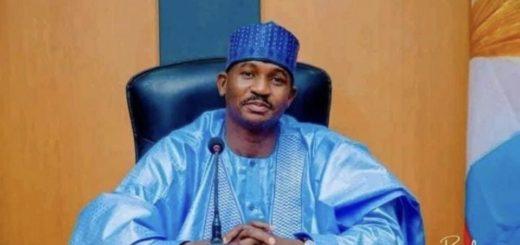

In his remarks, CBN Deputy Governor of Economic Policy, Muhammad Abdullahi, defended the bank’s tightening measures, stating that these were crucial in addressing inflationary pressures, anchoring inflation expectations, and fostering confidence in the economy. Abdullahi pointed out that the CBN raised the Monetary Policy Rate (MPR) by 875 basis points, bringing it to 27.5% by December 2024. Additionally, the Cash Reserve Requirement (CRR) for depository institutions was increased, further reinforcing the central bank’s efforts to stabilize the economy.

Abdullahi emphasized that these measures were vital to tackling inflation and maintaining the trust of market participants, ensuring long-term economic growth.

Meanwhile, the Minister of Budget and National Planning, Abubakar Bagudu, noted that peace in regions such as Borno, Kaduna, and Sokoto has contributed positively to inflation control, with increased food production helping to alleviate some of the economic pressures.

As Nigeria navigates these economic challenges, the CBN remains steadfast in its approach, with a focus on stability and growth in both the currency and broader economy.