Retirement: Labour seeks 50% lump sum payment

The Nigeria Labour Congress, NLC, has demanded for an increase in the lump sum payment on retirement to 50 percent under the Contributory Pension Scheme, CPS, to enable retirees begin a comfortable retirement life.

The Nigeria Labour Congress, NLC, has demanded for an increase in the lump sum payment on retirement to 50 percent under the Contributory Pension Scheme, CPS, to enable retirees begin a comfortable retirement life.

This is as NLC raised several questions agitating the minds of retiring workers.

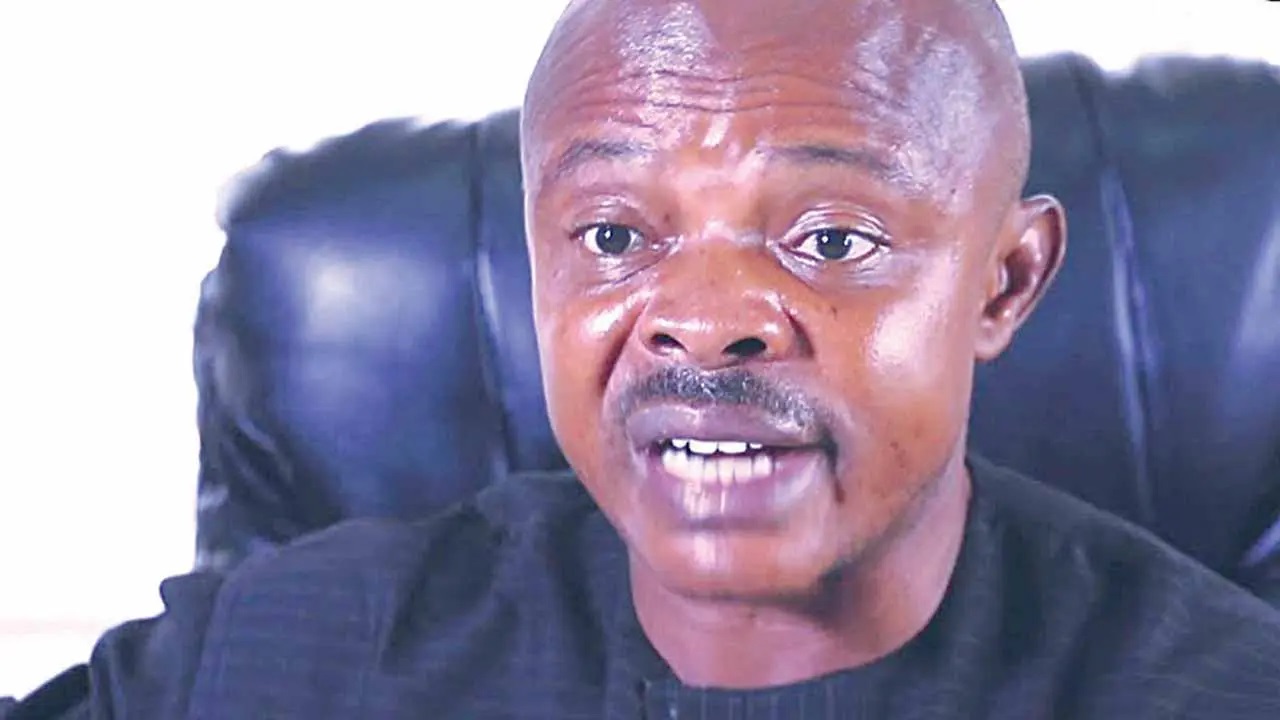

President of NLC, Joe Ajaero, at a programme on retirement in Abuja,said “Many Questions fill the minds of workers as they retire ; such as will my pension be paid immediately after I leave service? What will I survive on after my last salary in service? What will the real value of my pension be in terms of purchasing power? Will it be sufficient to cover my basic needs? Will I receive it regularly as expected? Will it be adjusted to keep pace with inflation to maintain its value?

“Will my pensions be sufficient to service my mortgage? Will my health challenges be sufficiently addressed by my pensions? etc These are fears that our pension system should address, yet, unfortunately, it often exacerbates them. Retirement, which should be a period of joy and rest, is too often perceived as a daunting prospect as a result of some of these.

“Nigerian Workers before and at retirement are confronted with life-changing challenges which include; Inadequate Pension Benefits Many retirees face, insufficient pension payments that fail to meet basic living expenses, Inflation and rising living costs erode the value of fixed pension incomes over time.

“For example, those who had saved up to N10 million in their Retirement Savings Account, RSA, before 2023 have seen this value dropped to around N3 million in real terms – a situation that is unacceptable. Pension schemes often lack proper indexation to adjust for cost of living increases due to inflation.

“Delayed Pension Payments; Inconsistent Policy Implementation and paucity of Support for Informal economy still persist thus necessitating the need for inclusive policies that integrate informal workers into the pension system.

“We demand the strengthening and reforming of the pension systems to ensure timely and adequate payments, make Pension governance more transparent to reduce looting.

“There is the need to introduce policies to index pension benefits to inflation and cost of living, expand social support systems to include affordable healthcare, housing, and community services, enhance financial literacy programs for retirees to help them manage their funds better.

“There should be policies to integrate informal sector workers into the pension framework, streamline and standardize pension policy implementation across all sectors and regions.

“More importantly there is urgent need to increase the percentage of lump sum payment on retirement to 50 percent and expand the investment windows available beyond housing via mortgage arrangements to allow for more investment options for workers to use their RSAs while in service.”