Tax review: Presidency mounts defence as 36 governors reject proposal

The 36 state governors of the federation have unilaterally demanded the immediate withdrawal of the National Tax Reforms Bill, delivering a significant strategic blow to the comprehensive efforts undertaken by the Taiwo Oyedele-led Presidential Fiscal Policy and Tax Reforms committee.

The 36 state governors of the federation have unilaterally demanded the immediate withdrawal of the National Tax Reforms Bill, delivering a significant strategic blow to the comprehensive efforts undertaken by the Taiwo Oyedele-led Presidential Fiscal Policy and Tax Reforms committee.

The governors, speaking during the National Economic Council – Nigeria’s highest economic advisory body – meeting on Thursday, asked President Bola Tinubu to withdraw the Reforms Bill from the National Assembly for more comprehensive consultations.

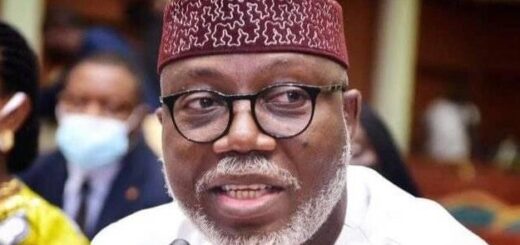

Oyo State Governor, Seyi Makinde, announced this as part of resolutions reached at the council’s 144th meeting chaired by Vice President Kashim Shettima at the State House, Abuja.

Makinde told journalists that council members agreed that it was necessary to allow for consensus building and understanding of the bills among Nigerians.

The meeting, which included a presentation by Oyedele, ultimately failed to persuade the governors regarding Tinubu’s plan to overhaul the taxation system aimed at achieving effective economic growth and increasing the tax-to-Gross Domestic Product ratio.

“Today (Thursday), NEC took a presentation from the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms. The primary focus is fair taxation, responsible borrowing and sustainable spending,” Makinde stated.

“After extensive deliberation, NEC noted the need for sufficient alignment between and amongst the stakeholders for the proposed reforms.

“So, Council, therefore, recommend the need to withdraw the bill currently before the National Assembly on tax reforms so that we can have wider consultations and also build consensus around these reforms for the benefit of the entire country, and also to give people…for them to know the vision and where we are moving the country in terms of tax reforms because there is a lot of miscommunication, misinformation.

“Council advised that the bill be withdrawn from the National Assembly, and then there will be consultations afterwards.”

President Bola Tinubu and the Federal Executive Council recently sponsored a bill to restructure and streamline tax processes, establish a unified revenue service and simplify financial obligations for businesses and citizens.

The reforms stemmed from a month-long review of existing tax laws by the Oyedele-led committee inaugurated in August 2023.

The committee’s recommendations were harmonized into four executive bills. They include the Nigeria Tax Bill, which aims to eliminate unintended multiple taxation and make Nigeria’s economy more competitive by simplifying tax obligations for businesses and individuals nationwide.

Secondly, the Nigeria Tax Administration Bill proposes new rules governing the administration of all taxes in the country.

Its objective is to harmonize tax administrative processes across federal, state and local jurisdictions to ease taxpayers’ compliance in all parts of the country.

Thirdly, the Nigeria Revenue Service (Establishment) Bill seeks to rename the Federal Inland Revenue Service as the Nigeria Revenue Service to better reflect the mandate of the Service as the revenue agency for the entire federation, not just the Federal Government.

Fourthly, the Joint Revenue Board Establishment Bill proposes the creation of a Joint Revenue Board to replace the Joint Tax Board, covering federal and all states’ tax authorities.

The fourth bill also suggests establishing the Office of Tax Ombudsman under the Joint Revenue Board, serving as a complaint resolution body for taxpayers.

However, the Council called for a second look. Its decision came three days after the Northern Governors kicked against the reforms bill.

At its last meeting on October 28, the Northern Governors’ Forum, consisting of 19 governors from the region, rejected the new derivation-based model for Value-Added Tax distribution in the new tax reform bills before the National Assembly.

A communiqué read by the Chairman of the forum, Governor Muhammed Yahaya of Gombe State, said the proposition negates the interest of the North and other sub-nationals. The forum said the bill portends massive job losses and more economic turmoil for the region.

However, the Presidency said contrary to job loss fears and perceived marginalization of the North, Tinubu’s tax reforms would benefit all states and harmonize the country’s tax laws for greater efficiency.

The Special Adviser to the President on Information and Strategy, Bayo Onanuga, argued this in a statement titled, ‘Explainer: Proposed tax reform bills not against the north; they will benefit all states’ on Thursday.

Onanuga said the proposed laws would not increase the number of taxes currently in operation. Instead, they were designed to “optimise and simplify existing tax frameworks,” he said.

“It’s instructive to note that these proposed laws will not increase the number of taxes currently in operation. Instead, they are designed to optimise and simplify existing tax frameworks.

“The tax rates or percentages will remain the same under these reforms, as they focus on ensuring a more equitable distribution of tax obligations without adding to the burden on Nigerians.

“The reforms will not lead to job losses. On the contrary, they are structured to stimulate new avenues for job creation by supporting a dynamic, growth-oriented economy. Importantly, these laws will not absorb or eliminate the duties of any existing department, agency, or ministry. Instead, they aim to harmonize revenue collection and administration across the federation to ensure efficiency and cooperation.”

The Presidency reasoned that Nigeria’s current tax administration lacked coordination among federal, state, and local tax authorities, often leading to overlapping responsibilities, confusion and inefficiency.

“Without reform, this inefficiency will persist,” Onanuga said.

He argued that the proposed laws aimed to “coordinate efforts between different tiers of government, resulting in better tax resource management and greater clarity for taxpayers.”

Under existing laws, taxes like Company Income Tax, Personal Income Tax, Capital Gains Tax, Petroleum Profits Tax, Tertiary Education Tax, Value-Added Tax, and other taxing provisions in numerous laws are administered separately, with individual legislative frameworks.

However, “The proposed reforms seek to consolidate these multiple taxes, integrating CIT, PIT, CGT, VAT, PPT, and excise duties into a unified structure to reduce administrative fragmentation,” the statement read.

On the proposed derivation-based VAT distribution model, which the northern governors oppose, the Presidency argued that “the new proposal, as enunciated in the Bill, is designed to create a fairer system.”

It explained that the current model for distributing VAT is based on where the tax is remitted rather than where goods and services are supplied or consumed.

“The ongoing tax reform seeks to correct the inherent inequity in the current derivation model as a basis for distributing VAT revenue.

“The new proposal before the National Assembly outlines a different form of derivation which considers the place of supply or consumption for relevant goods and services.

“This means that states in the Northern region that produce the food we eat should not lose out just because their products are VAT-exempt or consumed in other states,” Onanuga wrote.

According to the Presidency, these reforms are critical to improving the lives of Nigerians and were not put forward by President Tinubu to undermine any part of the country.

“There is no better time than now for the National Assembly to give due consideration to these bills that will overhaul our tax systems and create the revenue all the tiers of government require to fund the development our country and people urgently need,” the statement concluded.

NASS adjourns plenary

Amidst the controversy trailing the tax reform bill, which was forwarded to the National Assembly by President Tinubu, both the Senate and the House of Representatives on Thursday unexpectedly adjourned plenary to November 19.

Early last month, when the Chairman of the Federal Inland Revenue Service, Zacch Adedeji, had an interactive session with the Senate Committee on Finance on objectives of the tax reforms bill, a member of the committee, Dandutse Muntari, vowed that the proposed legislation would not see the light of the day.

The FIRS boss tried spiritedly to allay the fears of the lawmakers on possible tax increase but some of members of the committee said the time for such reform was not now.

The Senate on Wednesday listed the bill on its order paper for first reading but stood it down along with other items for screening and confirmation of appointments of the seven ministerial nominees forwarded to it by President Tinubu last week.

Alien to parliamentary practice, the bill was not listed on the order paper used by the Senate on Thursday for plenary proceedings.

Apparently disturbed by rejection of proposals contained in the bills by critical stakeholders like governors and Senators, including Ali Ndume (APC Borno South), Dandutse Muntari (APC Katsina South) and others, the Senate just about an hour into plenary, hurriedly moved into a closed door session .

Though the Senate Leader, Senator Opeyemi Bamidele (APC Ekiti Central), who moved motion for the hurried session, hinged it on matters relating to smooth running of the National Assembly, the Senate President, Godswill Akpabio, after about two hours of the session, said members deliberated on matters of urgent national importance.

He said, “Distinguished colleagues, the Senate at the closed door session deliberated on matters of urgent national importance. Is this a true reflection of what transpired at the closed door session?”

The Senators responded in the affirmative.

What further made the adjournment unexpected was the fact that after the closed door session, the Senate only considered the report of its Committee on Agricultural Colleges and Institutions but stood down the three other items listed for consideration.

Like a bolt from the blues, the Senate President, after consideration of the report on the bill seeking for an Act for the establishment of University of Agriculture and Tropical Studies, Iragbiji in Osun State, announced adjournment of plenary to November 19 for oversight and committee engagements.

According to the parliamentary calendar, lawmakers usually do not go on recess at this time of the year, when the President is expected to submit the budget and other related documents.

Meanwhile, the deputy spokesman of the House of Representatives, Philip Agbese, said it was up to the Federal Government to decide what to do with the advice of the 36 states governors on the Tax Reform Bill.

Agbese stated this in an exclusive interview with The PUNCH on Thursday.

He said, “It is an executive bill. At the level of the National Economic Council, which is one of the strongest arms of the executive; it is also an advisory board.

“As a parliament, we would not like to preempt what the executive would do with the advice by the 36 state governors, that the bill should be withdrawn. It is what is before the parliament that we will consider.”

He pledged the readiness of the House to consider the bill on merit, saying, “The bill will be considered on its merit and debated squarely on the floor of the House of Reps dispassionately by members from North and South as well as people representing the eight political parties.

“We will support the bill if it will stop the hardship in the country and help to build our roads, schools and other infrastructures.”

Northern govs’ stand

The PUNCH learnt that the Sokoto State Governor, Ahmad Aliyu, had expressed readiness to stand by the resolution reached by the Northern Governors Forum on the bill at a meeting with the region’s top monarchs on Tuesday in Kaduna.

A top aide of the governor, who spoke on condition of anonymity because he was not authorised to speak on the matter, said the even though the governor had not made any official statement on the issue, he would stand by the resolution reached by the leaders of the region in Kaduna.

He said, “The governor will definitely work in tandem with the resolution reached with his colleagues in Kaduna. The governor is passionate about his people and what concerns them, he will work to protect their interest.

“The decision reached in Kaduna is not a personal opinion of one person but a collective one by leaders of the region, so, it is only the collective leaders that can say anything otherwise.”

On insinuations that the 19 northern governors might mobilise its National Assembly members against thwarting the bill, Special Adviser to the Plateau State Governor on Policy and Governance, Yiljap Abraham, stated, “I can’t say anything regarding that for now, but I think there is something the northern governors are doing that will go beyond what they have said .I think we just have to wait a little bit and then we hear about it “

It was learnt that the Niger State Governor Umar Bago was working in collaboration with the state’s lawmakers on the FG’s proposed tax reform bill.

The state Commissioner for Finance, Lawal Maikano, gave the hint on Thursday in a text message to The PUNCH.

Maikano said, “The Governor is already on it (tax reform), and the assembly members are well aware of the position of the state.”

Following the Presidency comments on the proposed VAT Reform Bill as it is not against the interest of the North,

The Katsina State Governor’s Director-General, Media, Maiwada Danmallam, said Governor Dikko Umar Radda and the other governors in the region would reconvene to take further decisions on the issue.

He said, “It’s rather early for any state to react to this matter in isolation. The rejection of the proposed VAT reform was a collective decision by governors of the states, hence, it should be expected they have to reconvene as a body to review this development and decide their next line of action.”